The debtor re-finances only the primary equilibrium or perhaps less. If rate of interest are currently lower than what you currently pay on your FHA loan, it might be time to consider refinancing. An excellent scale is if you can decrease your price by at least half a portion factor.

- The greater your credit score, the lower your FHA rate of interest will certainly be

- There are seven points that lending institutions think about when determining home loan interest rates.

- If you take down less than 10%, you'll pay FHA mortgage insurance policy for the life of the funding.

- Even if you have a credit score as low as 600, you may still bluegreen maintenance fee calculator qualify for a Guild Mortgage FHA financing.

By January 2021, those exact same lendings might be protected at an ordinary rate of 2.74%, before ticking up somewhat to 2.81% in the next month. FHA home loan insurance policy protects the lending institution's funding quantity if you default on your lending. Just like exclusive home mortgage insurance policy on a standard finance, this plan is paid by the customer, yet just extends insurance coverage to the borrowing organization's investment in the residential property. In the event of default or repossession, the home mortgage insurance company would reimburse the lender for their losses.

Comprehending The Closing Process

However as a compromise, if you have low credit history and also restricted funds, it assists you qualify for a mortgage to manage a residence. Lenders evaluate your debt-to-income proportion, which helps loan providers figure out mortgage eligibility. Expressed in percentage, DTI ratio is a threat indicator that determines the amount of your financial debt payments in connection with your overall regular monthly earnings. Having a high DTI proportion recommends you will likely have problem meeting month-to-month repayments. This shows it's not a good suggestion to handle additional debt, unless you reduce your current balance or pay the majority of them off.

Find Out More Regarding Fha Financings

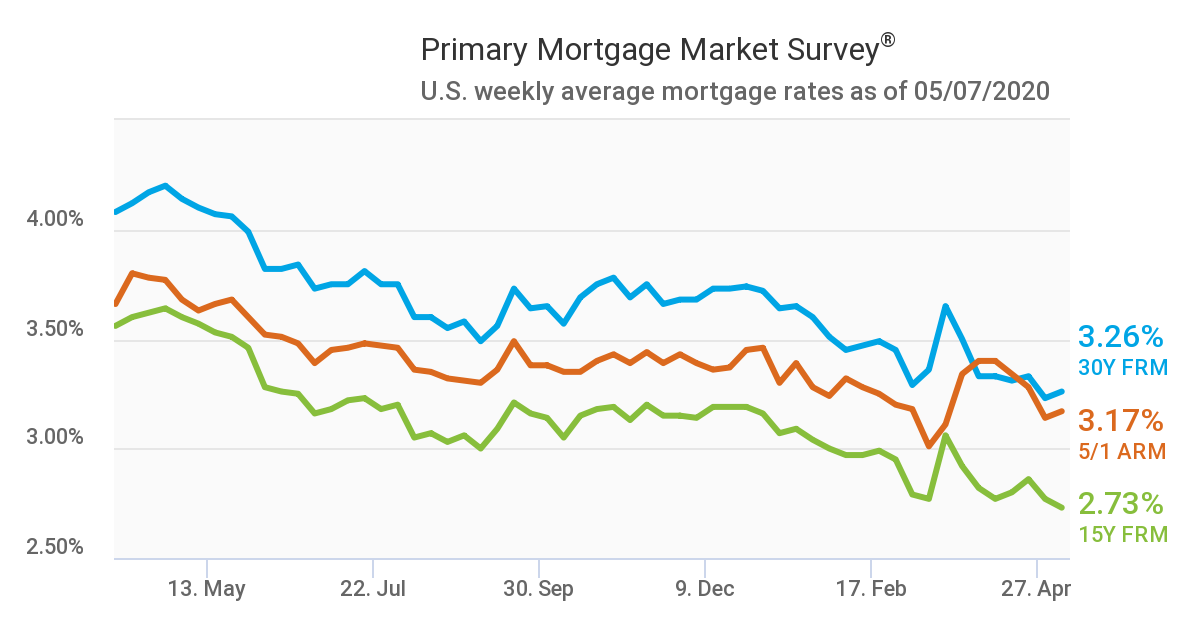

So a 5/1 ARM readjusts the price after 5 years and afterwards every year afterwards. As the economic situation recuperates and also the Federal Book announced its plan to scale back its low-rate policies the most likely end result will certainly be climbing mortgage prices. Nevertheless, the assumption amongst professionals isn't for skyrocketing prices overnight, however instead a progressive surge with time. Exclusive home mortgage insurance and get approved for much better rate of interest. Buying MBS and treasury bonds, and also this increased demand has actually resulted in the most affordable home mortgage rates on record.

# 1 Mistake People Make When Browsing Mortgage Rates

When contrasting offers from various lending institutions, request for the same amount of points or debts from each lending institution to see the distinction in mortgage rates. With traditional mortgages, lending institutions typically authorize consumers with a credit score of 680 and above. If your credit report drops at 620 and also below, it's harder to acquire a standard car loan. With traditional home loans, the higher your credit https://writeablog.net/lewartn8er/a-countered-mortgage-enables-you-to-offset-your-financial-savings-against-your history, the reduced the price you'll receive. At the same time, if you have a low credit Find out more rating, you're bound to obtain a much higher price with a traditional funding. In various other situations, a conventional lending institution may not accept your application whatsoever.